3 ways to mess with your friends if you had their IC numbers

The Ministry of Digital Development and Information (MDDI) says your NRIC is just a number.

It doesn't have to be treated as sensitive information. In fact, you can routinely share and reveal it to others, just like you do with your full name.

But what if that number falls into the wrong hands?

Let's just say, hypothetically, a "friend" gets a little too curious about your NRIC...

Here are a few potential scenarios that might give you pause.

1. Impersonation: More Than Just a Prank Call

Imagine this: Your phone rings, and a "representative" from your telco service provider informs you of a technical issue or billing discrepancy.

To reassure you, they even confirm your IC number – a detail they already possess.

After all, you used it to sign up for their service.

They then request further information – security questions, perhaps even banking details – under the guise of resolving the issue.

They might use this information to gain access to other accounts.

They might also use the gathered information to craft highly personalised phishing emails or SMS messages – messages so convincing that you're more likely to fall victim, revealing even more sensitive information like credit card details or one-time passwords.

What did you say your mother's maiden name was again?

2. SingPass: A Digital Gateway Vulnerable to Exploitation?

SingPass, crucial for accessing essential government services, relies heavily on personal identification.

But what if your IC number falls into the wrong hands?

Malicious actors can potentially initiate account recovery processes, locking you out and disrupting access to vital services, from CPF transactions to tax filing.

The impact on daily life can be significant.

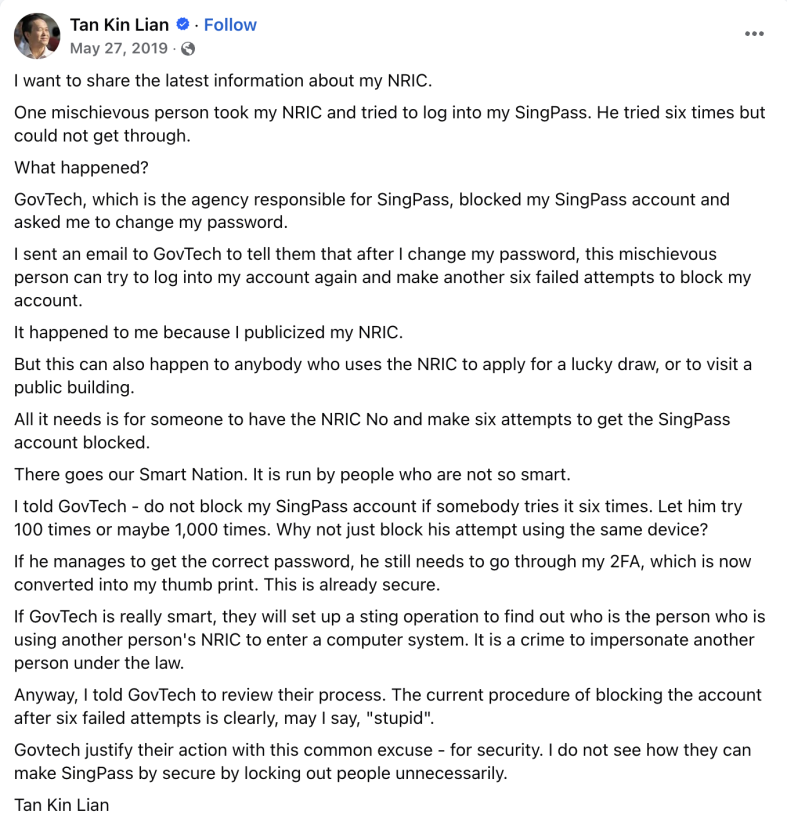

This isn't a theoretical risk. Former presidential candidate Tan Kin Lian publicly shared his personal data in 2019 and subsequently had his SingPass account locked in 2019.

I mean, it can happen to the best of us.

3. Card Cancellation Chaos: More Than Just an Inconvenience

The scenario: A malicious actor obtains your IC number and other readily available personal information.

Armed with these details, they impersonate you, contacting your service providers — telcos, utility companies, even banks.

They report a "problem", request account changes or even attempt to access financial information.

What can go wrong?

Plenty.

Your accounts can be compromised, leading to unauthorised transactions and significant financial losses.

Even if the malicious party can't get into your accounts, essential services could be disrupted, causing major inconvenience.

This isn't just a hypothetical fear. This is exactly what happened to Singaporean Melvin Chan while he was on holiday in Japan.

Someone, armed with his IC and personal details, contacted his banks, impersonated him and cancelled his cards, leaving him financially stranded in a foreign country.

I'd rather be at work on Christmas Day than have this happen to me.

Beyond Inconvenience

These incidents aren't isolated. They represent a systemic vulnerability amplified by an accessibility to IC numbers.

While the government maintains its stance on IC numbers as public identifiers, a re-evaluation of data protection policies and procedures is urgently needed.

The convenience of using IC numbers as identifiers should not compromise individual security and privacy.

The responsibility lies with individuals, institutions and the government to protect our digital identities.

Here's what you can do right now to safeguard yourself:

- Be Vigilant: Verify the identity of anyone contacting you requesting personal information. Be wary of unsolicited calls or emails.

- Monitor Your Accounts: Regularly check your bank and credit card statements for any suspicious activity.

- Secure Your SingPass: Enable two-factor authentication. Choose strong, unique passwords, and update them regularly. Be vigilant against phishing attempts.

- Set Up Alerts: Enable transaction alerts for your bank accounts and credit cards to be notified of any unusual activity.

- Report Suspicious Activity: Immediately report any suspicious activity to your bank or relevant authorities.

- Think Before You Share: Be incredibly cautious about sharing your NRIC and other personal information. Remember, in the wrong hands, this information can be used against you.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now