$6.7m lost to bank and govt official impersonation scams in Sept

In a joint statement on Oct 10, the Singapore Police Force (SPF) and Monetary Authority of Singapore (MAS) said there has been a rise in scams featuring the impersonation of banks and government officials.

In September alone, there were at least 100 cases reported, with total losses amounting to at least $6.7 million.

The victim would receive an unsolicited call from a scammer impersonating a bank officer, typically from DBS, OCBC, UOB or Standard Chartered Bank.

The scammer would inform the victim that a credit card had been issued under the victim’s name, or that there were suspicious or fraudulent transactions detected in the victim’s bank account, and would ask the victim to confirm these financial transactions.

When the victim denies knowledge of such transactions, the scammer would transfer the call to a second scammer who would impersonate a government official (from SPF or MAS).

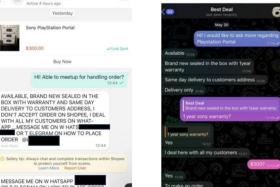

These calls could, at times be in the form of video calls, with the scammers dressed as SPF or MAS officers with fake badges, against a backdrop with the agency’s logo.

The communication between the second scammer and the victim may subsequently be moved to messaging applications such as WhatsApp.

In some instances, the scammers may provide fake warrant cards or fake official documents to lend credence to their deceit.

The scammers would accuse the victim of being involved in criminal activities such as money laundering and ask the victim to transfer

monies to “safety accounts” designated by the government to assist in investigations.

Members of the public are reminded to add security features to their bank accounts, check for scam signs with official sources and tell the authorities, family and friends if or when you encounter scams.

If you suspect that you have fallen victim to a scam, call the bank immediately to report and block any fraudulent transactions as well as make a police report.

For more information on scams, go to scamshield.gov.sg or call the ScamShield Helpline at 1799.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now