7 things to know about the Majulah Package

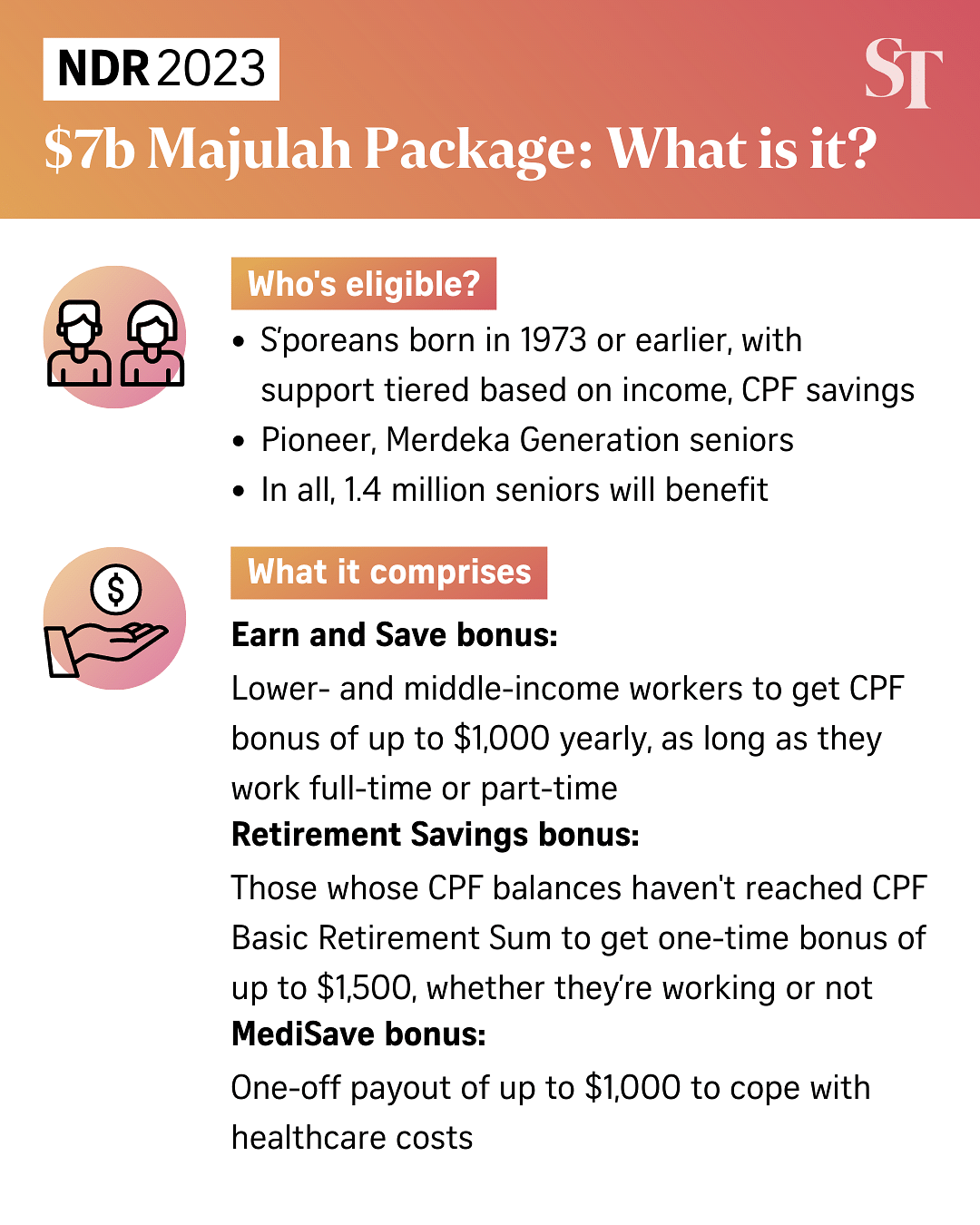

The Majulah Package is a new support package aimed at helping boost the retirement adequacy of lower and middle-income Singaporeans aged 50 and above this year.

It will cover “young seniors” in their 50s and early 60s, said Prime Minister Lee Hsien Loong when announcing it at the National Day Rally on Sunday.

It will also cover those of the Merdeka Generation who were born between 1950 and 1959, and those of the Pioneer Generation who were born in 1949 or earlier.

Here are seven things to know about the new Majulah Package:

1. What is it?

The Majulah Package comprises three components – a yearly Central Provident Fund bonus for those who remain in the workforce, a one-time CPF Retirement Savings Bonus (RSB) for those who have yet to meet their Basic Retirement Sum (BRS) and a one-time MediSave bonus.

The first component of the package is the Earn and Save Bonus, which provides lower- and middle-income workers with a CPF bonus of between $400 and $1,000 yearly, as long as they remain in the workforce, whether full- or part-time. This bonus will be credited into the recipient’s CPF account, on top of the usual employer and employee contributions.

To further prepare older Singaporeans for retirement, those whose CPF balances have not reached the CPF BRS will benefit from the CPF RSB. They will receive a one-time CPF bonus of between $1,000 and $1,500.

As concerns surrounding the cost of healthcare increases for many Singaporeans as they age, the Majulah Package will also include a MediSave Bonus, a one-time top-up of between $500 and $1,000.

2. When will I receive the payouts?

Details on the timeline of the disbursement of the bonuses will be announced in 2024.

3. Who can benefit from the package?

The package is aimed at supporting the retirement needs of lower and middle-income Singaporeans aged 50 and up. It will provide tiered financial support, based on income and CPF savings, to about 1.4 million Singaporeans. This means that more than eight in 10 Singaporeans in the age group will stand to benefit.

The package will cover those born in 1973 and earlier – young seniors aged between 50 and their early 60s, those of the Merdeka Generation born between 1950 and 1959, and those of the Pioneer Generation born in 1949 or earlier.

All eligible Singaporeans who are working will benefit from the Earn and Save bonus, regardless of employment type. This includes platform workers, part-time workers and gig workers.

The remaining bonuses will be available to all Singaporeans who meet the eligibility criteria. The Majulah Package is means-tested, so the eligibility criteria will include factors such as income, annual value of residence, property ownership and CPF savings.

More details on the eligibility criteria will be announced in 2024.

4. Why is the Majulah Package necessary?

The package targets young seniors, who PM Lee said have benefited more from Singapore’s growth and have generally done better compared with the Pioneer and Merdeka generations. But they have earned less over their lifetimes when compared with younger workers who are in their 30s and 40s.

They also have less time to benefit from improvements to the CPF system and have built up less retirement savings.

The package seeks to alleviate anxiety about retirement for this group as they are “in a particularly sandwiched phase” of their lives, having to shoulder the responsibility of caring for both the young and old in their families.

Many have children who are young adults who are not yet fully independent and may still live with them, as well as elderly parents who may require additional care, such as medical attention as well as help with daily tasks and needs.

They also have their own health to worry about and these factors can lead to additional pressures on top of worries surrounding the daily cost of living.

Additionally, the Earn and Save Bonus also seeks to encourage Singaporeans to remain in the workforce for as long as they can.

5. How much can I get from the package?

Depending on their income and CPF savings, older Singaporeans will be able to benefit most from the package if they continue to work.

Under the Earn and Save Bonus, they will receive a CPF bonus of between $400 and $1,000 yearly, as long as they remain in the workforce, whether full- or part-time.

For example, 55-year-old lower-income workers with less wealth can receive up to an extra $12,000 in CPF savings, including interest, from the annual Earn and Save Bonuses if they work for 10 more years and retire at age 65.

Additionally, if their CPF balance has not reached the CPF BRS, they will benefit from the CPF RSB – a one-time CPF bonus of between $1,000 and $1,500.

They will also benefit from the MediSave Bonus, a one-time top-up of between $500 and $1,000.

6. Why is the package paid to CPF and not in cash?

The Manpower Ministry said that because the Majulah Package is meant to help older Singapore citizens with their retirement and healthcare needs, the benefits are paid to the CPF accounts to boost their retirement and healthcare savings.

The savings in their CPF accounts will grow with interest and can be streamed out via monthly CPF payouts in retirement, or used directly for their healthcare needs.

7. Who will fund the package?

The Ministry of Finance will create a fund to meet the full lifetime costs of the Majulah Package, using resources from the current term of government.

PM Lee said: “We will honour this commitment without burdening future generations.”

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now