Decoding insurance: Do you know what you're covered for?

Last month, a Gleneagles Hospital security guard ended up with a $78,000 bill after collapsing on duty.

Mr Thomas Lukose, 55, has MediShield Life, but that didn't come in handy because there was no intensive care bed available at the National Heart Centre Singapore (NHCS), where he could get subsidised care.

When a bed did open up at NHCS three days later, Mr Lukose's condition was deemed so unstable that moving him was not viable.

Thankfully, his surgeon did not charge any fee. Gleneagles, too, decided to waive the $78,000 bill, of which $13,500 was covered by his work insurance.

While the situation could have been avoided if Mr Lukose had an Integrated Shield Plan that covers private hospital costs, his wasn't a case of no ample planning for the future.

"It's not that he had basic coverage but decided to stay in a private hospital," SingCapital chief executive Alfred Chia pointed out.

But for the rest of us, the incident is a reminder that health policies should be your "first line of defence", he said.

The most serious misconception is to assume health insurance is not a necessity when you are young and healthy, said Mr Sebastien Roger, AXA's deputy director of strategy & products, health and employee benefits.

Some may also put off buying insurance because they think premiums are expensive, said Aviva's director of product and marketing Daniel Lum.

"Taking on a comprehensive insurance plan also grants one the ease of mind, allowing us to better enjoy life's important moments," he said, adding that the benefits of purchasing an insurance policy goes beyond that of financial compensation during an emergency situation.

What are the types of health insurance plans?

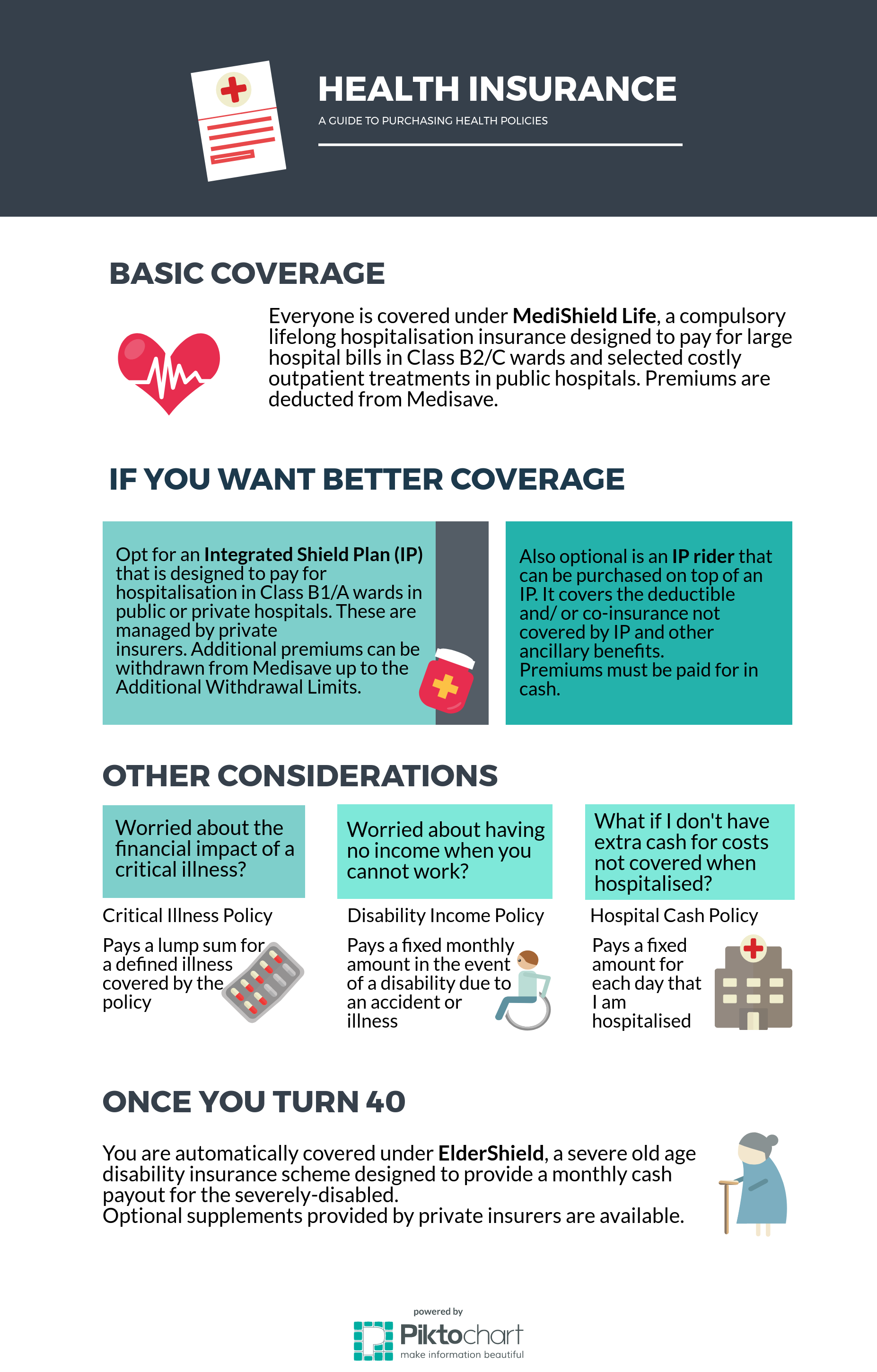

There are five different types of health policies.

Medical expenses - reimburses medical expenses (both inpatient and outpatient) incurred due to an accident or illness, such as MediShield Life.

Long-term care - pays a fixed amount of benefit each month towards expenses for long-term nursing treatment for those who cannot perform some 'activities of daily living', such as ElderShield.

Critical illness - pays a lump sum for a defined illness covered by the policy

Disability income - pays a fixed monthly amount in the event of a disability due to an accident or illness

Hospital cash - pays a fixed amount for each day hospitalised

Is MediShield Life enough for me?

This will depend on individual circumstances and the kind of treatment, hospital and ward they want access to, said Aviva's Mr Lum.

SingCapital's Mr Chia suggests following a "4-3-2-1" guideline - 40 per cent on debt servicing, 30 per cent on expenses, 20 per cent on savings and 10 per cent on insurance or protection. As premiums go up as you age, it is important to make sure that you can afford the premiums in your silver years, Mr Chia added.

For more, please refer to:

When should I buy my first health policy?

Get it when you have the financial ability to do so, as early as possible. As we age, there is the risk of developing specific ailments which affects what the insurer may be willing to cover, while premiums will only increase as we get older, said Aviva's Mr Lum. As it is often difficult for people to appreciate their insurance needs and select the right coverage, insights from a financial advisor will be helpful, said AXA's Mr Roger.

What should I look out for in health insurance policies?

1. Age limit

Unlike MediShield Life, some policies are not available to people over a certain age. It is generally better to buy health insurance at an early age, when you are still healthy and able to get all the benefits of health insurance. Some policies may cover you up to a certain age, so choose one that suits your needs.

2. Premiums

Check how your policy charges premiums. For medical expense insurance policies, the premiums increase with age, and with claims and medical costs. Check if your insurer has the right to change the premium at any time through written notice.

"Most people will only check their insurance coverage when they have a claim, which is often too late: it is important to check in advance the coverage of an insurance plan with one's employer and/or financial advisor," said AXA's Mr Roger.

3. Terms

Make sure you are clear with the terms of the policy before buying it. Are you allowed to change benefits, premium rates or other terms and conditions before your policy is due for renewal?

4. Policy exclusions

Find out when benefits will not be paid, and what exactly you are not covered for. A common exclusion in health insurance is your pre-existing condition. The definition of pre-existing condition may vary from policy to policy. If you already have a medical condition before buying a policy, give full details in your application. Your insurer will then decide whether to fully cover the condition.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now