Police warn of fake GST voucher app targeting Android users

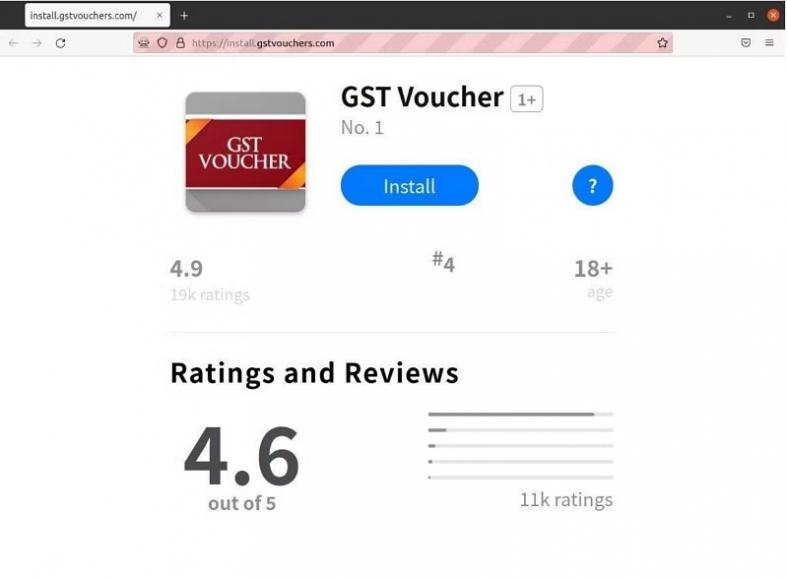

The police have issued a warning about a new scam involving a fake Goods and Services Tax (GST) Voucher mobile app – the latest variant in scams that trick the public into downloading apps from third-party sites.

The police said on Friday that the scam has been making its rounds on social media, with posts made on Facebook and messages shared on platforms like WhatsApp, encouraging Android phone users to download and sync the fake app with their bank accounts.

Victims are lured into downloading an Android Package Kit (APK) file labelled as “GST Voucher” to redeem GST vouchers but, in reality, the file is malicious.

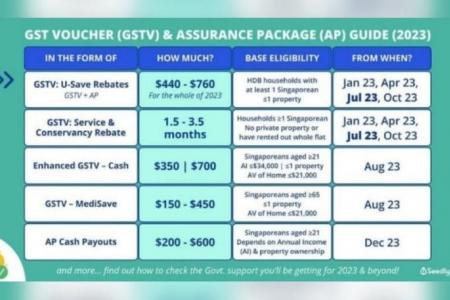

GST Vouchers are disseminated through PayNow for those who have linked their NRICs to it. Those who have not will receive it through direct bank crediting.

Meanwhile, for citizens who have neither provided their bank accounts nor linked their NRICs to PayNow, they can withdraw the amount at OCBC automated teller machines islandwide. This can be done only after entering payment reference numbers that are sent to them from Aug 21, their NRIC number, as well as after verification via facial recognition.

This can be done even without an OCBC bank account.

The police advise the public not to download any suspicious APK files, which could contain malware enabling scammers to remotely access and control the device and steal stored passwords.

They also reminded the public of the dangers of downloading applications from third-party or dubious sites, which can lead to malware being installed on their devices.

To protect themselves from being scammed, the police said to install anti-virus apps on devices, recommending that people regularly update their operating systems and applications.

Apps should also be downloaded from only official app stores, they added.

Those who may have downloaded third-party apps and suspect that their phones are infected with malware are advised to switch their phone to flight mode, run an anti-virus scan, and check for unauthorised transactions. If there are any found, they should be reported to the bank and the police.

In July, Android users were warned not to download any application from an SMS claiming to be from the police’s Anti Scam Centre.

The police said since January, they have received more reports of Android devices being exposed to malware, which resulted in unauthorised transactions involving the victims’ bank accounts.

This occurred despite victims not disclosing their Internet banking credentials, one-time passwords or Singpass details to anyone.

If the public have any information to such crimes, they should contact the police hotline at 1800-255-0000 or submit it online at www.police.gov.sg/iwitness

For more information on scams, the public can visit www.scamalert.sg or call the Anti-Scam Helpline at 1800-722-6688.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now