Victims lose $36m to conmen touting investments

Victims lost at least $36 million in less than two months to conmen touting investment scams on chat groups and social media platforms, police said.

In a statement on Aug 14, the police said there were 897 cases of investment scams reported since July, in which victims were lured into parting with money to channel into investments, which then turned out to be scams.

Recently, scammers used two methods. The first involved adding victims into chat groups or communication channels. The second method involved befriending the victims on social media platforms.

In the first method, victims were added into chat groups on platforms such as Telegram, and the scammers pretended to be famous people or reputable companies, said the police.

Unidentified people in the chat group would then claim to have profited from their investments, and shared screenshots of their profits, in an attempt to make victims believe that the investments were authentic and profitable.

After the victims contacted the scammers, they were offered a raft of investment plans, and were asked to provide their personal details like their bank account number, name, and phone number, and transfer money to specified bank and PayNow accounts.

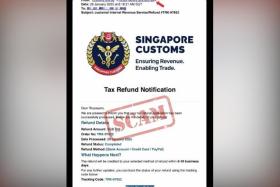

Fake investment websites or applications were also sometimes used to display fake profits, making the scam look more believable, the police added.

The second method involved scammers contacting victims through social media platforms like Facebook or WhatsApp, or dating applications like Coffee Meets Bagel.

After building rapport and gaining the trust of victims, scammers would talk to them about investment opportunities. Those who were interested would then follow the instruction of scammers to transfer money to specified bank or PayNow accounts.

The victims were led to believe that the investment was genuine because they would get profits at first, and the fake investment websites or apps would show growing profits – resulting in investments of larger amounts from victims.

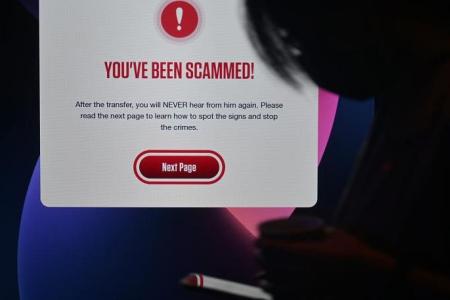

In both scenarios, victims would realise they got scammed only when they found out that they were unable to withdraw their profits, despite having transferred large sums of money.

The scammers also later became uncontactable, said the police.

To avoid being a victim of scams, the police urged members of the public to adopt the following measures:

- ADD - Set security features, such as by disallowing unknown users from adding you into chatgroups; set transaction limits for internet banking transactions; and enable two-factor authentication.

- CHECK - No legitimate investment company would add you into a group chat to sell an investment opportunity. Verify the authenticity of information by asking as many questions as needed to understand the investment opportunities, checking on the company; its owners, directors, and management to assess if the investment opportunities are genuine, and confirm the company’s and representatives’ credentials by using available resources such as the Financial Institutions Directory.

- TELL - Let the authorities, family and friends know about scams. Report any fraudulent transactions to your bank immediately.

Those who have information about such scams or have doubts should contact the police hotline on 1800-255-0000.

They can also make a submission online through the i-Witness portal.

For more information about scams, visit scamalert.sg or call the Anti-Scam Helpline.

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now