13,000 travellers fined more than $3m over undeclared goods

More than 13,000 travellers have been fined for evading taxes across air, land and sea checkpoints since January.

In total, 13,099 travellers were fined $3,471,043, said the Singapore Customs in a statement on Nov 15.

This is almost double the number of 7,193 travellers caught over the same period in 2023, who were fined a total of $2,303,380.

In one case, during a bag inspection, officers discovered various undeclared luxury bags and accessories on a woman flying back from a business trip in London.

The bags and accessories, which were intended as gifts, were from brands such as Louis Vuitton, Prada, Yves Saint Laurent, Dior and Balenciaga. There were also Pop Mart toys, including Labubu figurines.

She was fined $5,000 and had to pay $3,963.69 in goods and services tax (GST) on the items.

According to the Singapore Customs, the traveller admitted she was aware of the GST relief limits, but believed that only items for personal use required declaration.

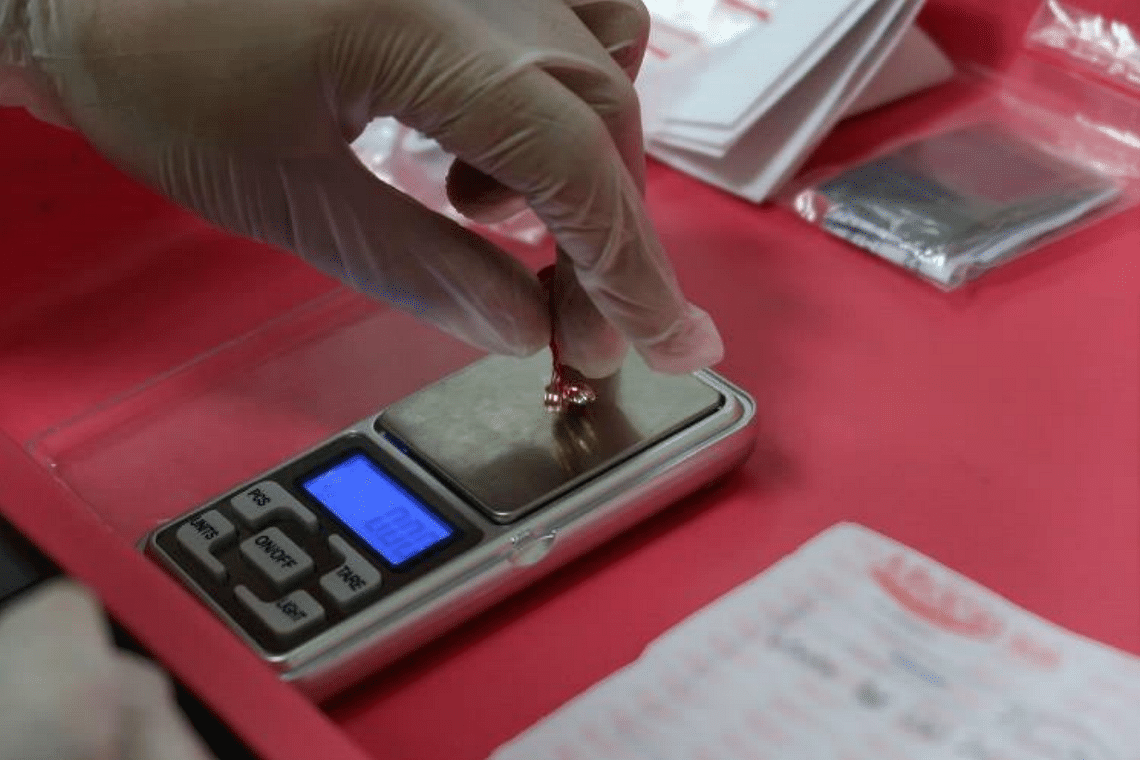

Another case involved a woman who was intercepted at the Singapore Cruise Centre.

The repeat offender was found with new and used gold jewellery intended for commercial purposes.

She was fined $1,935 and had to pay $96.95 in GST.

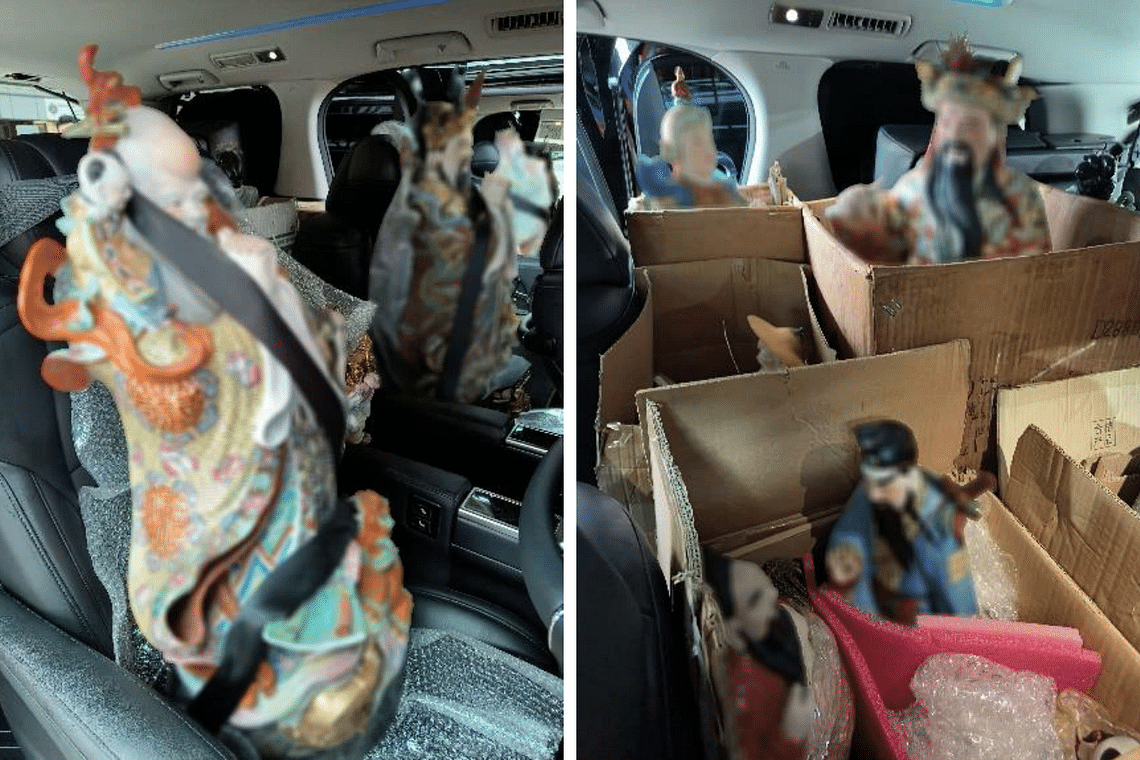

In a third case, a man at Woodlands Checkpoint was couriering items on behalf of another person. He was questioned after a failed transaction at the self-help Customs Declaration Kiosk.

Officers discovered undeclared items in two vehicles. A further search uncovered several undeclared invoices. Photos from the Singapore Customs showed statues of deities.

The man was fined $3,920 and had to pay $441.05 in GST on the items.

Of the cases so far in 2024, 46 offenders were handed the maximum penalty of $5,000 for making incorrect or incomplete declarations to customs.

Singapore Customs said common violations in 2023 and 2024 involved:

- Commercial goods, such as renovation materials, carpentry items and machinery parts;

- Apparel and accessories, such as bags, clothes, mobile phones and watches;

- Health and food products;

- Cigarettes and alcohol, such as those that are duty-unpaid and exceeding the duty-free allowance.

Under the Customs Act, anyone found guilty of evading duties can be fined up to 20 times the amount of duty and GST evaded, or jailed for up to two years.

“This revenue belongs to Singapore, and its collection is essential to maintaining a level playing field for local businesses that pay these taxes,” said a Singapore Customs spokesperson.

“The responsibility falls on all arriving travellers to declare all goods in their possession accurately and pay the applicable duties and/or GST.”

Get The New Paper on your phone with the free TNP app. Download from the Apple App Store or Google Play Store now